Hann, Murphey, and Ryan have operated a retail furniture store for the past 30 years. Their business

Question:

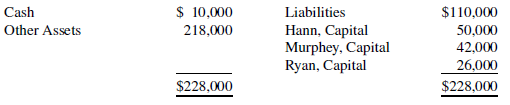

Hann, Murphey, and Ryan have operated a retail furniture store for the past 30 years. Their business has been unprofitable for several years, since several large discount furniture stores opened in their sales territory. The partners recognize that they will be unable to compete with the larger chain stores and decide that since all the partners are near retirement, they should liquidate their business before it is necessary to declare bankruptcy. Account balances just before the liquidation process began were as follows:

The partners share profits in the ratio of 5:3:2, respectively. Rather than selling all the assets in a forced liquidation and incurring selling expenses, the partners agree that some of the noncash assets may be withdrawn in partial settlement of their capital interest. The partners agree that if the market value of a withdrawn asset is less than book value, the difference should be allocated to all partners in their loss ratio. If market value is greater than book value, the asset is to be adjusted to its market value before recording the withdrawal. All the partners are personally solvent and can make additional cash investment in the partnership up to $20,000 each. The following is a schedule of transactions that occurred during 2019 in the liquidation process.

March 15, 2019 During liquidation sale, noncash assets with a book value of $90,000 were sold for $80,000.

March 16, 2019 Sold accounts receivable with a book value of $30,000 to a factory for $26,000.

March 16, 2019 Paid all recorded partnership creditors.

March 18, 2019 Distributed all but $1,000 of available cash to partners.

March 19, 2019 Murphey withdrew from inventory furniture with a book value of $10,000 and a market value of $13,000 to satisfy part of his capital interest.

March 21, 2019 Sold remainder of inventory with a book value of $50,000 to a discount furniture store for $30,000 cash.

March 25, 2019 Assigned for $12,000 cash the remaining term of the lease on the warehouse. The lease was accounted for as an operating lease.

March 25, 2019 Distributed all available cash to partners.

April 1, 2019 Hann agreed to accept two vehicles with a book value of $10,000 and a market value of $8,000 in partial settlement of his capital interest.

April 5, 2019 All remaining assets were sold for $4,000.

April 6, 2019 Received additional cash from partners with debit capital balances.

April 6, 2019 Distributed available cash to partners.

Required:

Prepare a schedule of partnership realization and liquidation in accordance with the sequence of the foregoing events. Compute a safe payment to support your cash distribution to partners.

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer: