In 2013, AB InBev acquired the remainder of the stock of Grupo Modelo, and began consolidating it

Question:

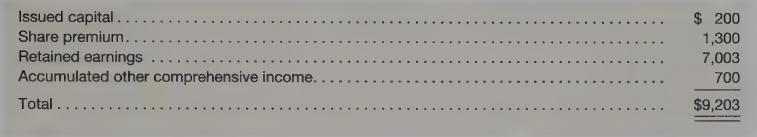

In 2013, AB InBev acquired the remainder of the stock of Grupo Modelo, and began consolidating it as a wholly-owned subsidiary. Acquisition cost was \($34,008\) million. Grupo Modelo’s equity balances at the date of acquisition were as follows (in millions):

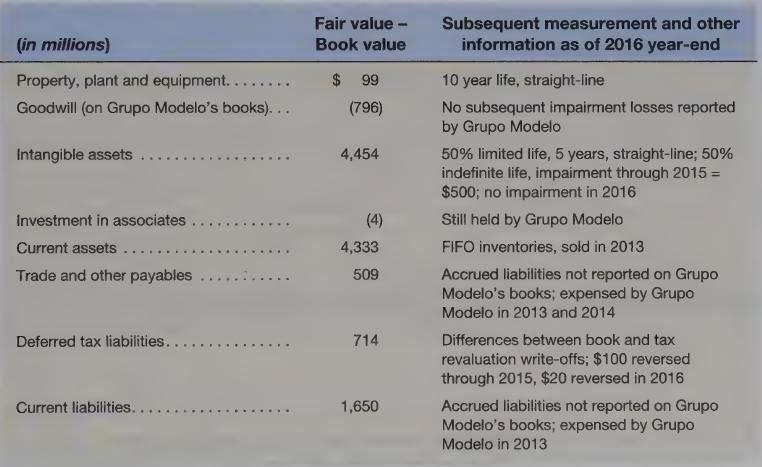

Below is a summary of the date-of-acquisition revaluations of Grupo Modelo’s identifiable net assets, and assumed subsequent measurement for each. Assume the acquisition took place at the beginning of 2013.

All numbers are in millions.

Goodwill of \($19,592\) million was recognized for this acquisition. The goodwill has not been impaired.

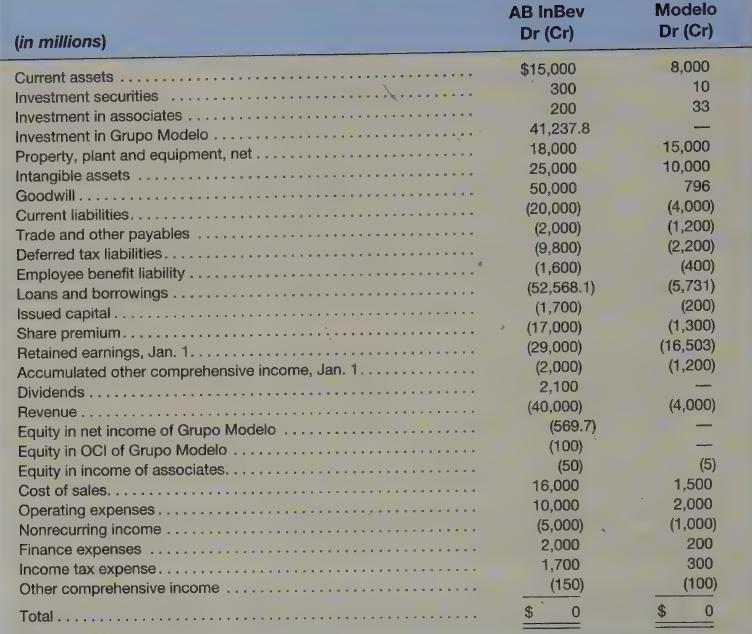

It is now December 31, 2016, four years after the acquisition, and you are preparing the working paper to consolidate Grupo Modelo with AB InBev. The following are the assumed trial balances of each company at that date. AB InBev’s investment balance is reported using the complete equity method.

In your answers below, show all amounts in millions.

Required

a. Prepare a schedule to calculate AB InBev’s equity in net income of Grupo Modelo, reported on its December 31, 2016, trial balance at \($569.7\) million.

b. Prepare a schedule to calcylate AB InBev’s investment in Grupo Modelo balance, reported on its December 31, 2016, trial balance at \($41\) ,237.8 million.

c. Prepare the December 31, 2016, consolidation working paper.

d. Prepare the 2016 consolidated statement of comprehensive income and the December 31, 2016, consolidated balance sheet, in good form.

Step by Step Answer: