In 2013, AB InBev completed its acquisition of Grupo Modelo. AB InBev had previously held a significant

Question:

In 2013, AB InBev completed its acquisition of Grupo Modelo. AB InBev had previously held a significant interest in Grupo Modelo. Although AB InBev is headquartered in Belgium, its financial statements are reported in U.S. dollars. The footnotes to AB InBev's 2013 annual report reveal the following information on this acquisition:

• Consideration paid: Cash, \($20,103\) million; fair value of previously held equity interest, \($12,946\) million.

• AB InBev revalued the previously held equity interest to fair value at the date of acquisition, and recycled \($199\) million in gains from AOCI to income, resulting in a net non-recurring non-cash gain of \($6,410\) million.

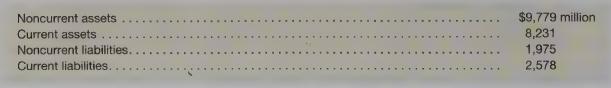

• The fair values of Grupo Modelo’s identifiable assets and liabilities at the date of acquisition were as follows:

Required

a. Calculate the amount of goodwill AB InBev reported for this acquisition.

b. Why did AB InBev recycle \($199\) million in gains from ‘AOCI to income?

c. Prepare the summary journal entries AB InBev made to record the acquisition as a merger.

d. At what amount did AB InBev report its investment in Grupo Modelo just prior to the acquisition?

Step by Step Answer: