Kelly Company acquired 75 percent of Helton Companys outstanding voting shares on January 1, 2019, in exchange

Question:

Kelly Company acquired 75 percent of Helton Company’s outstanding voting shares on January 1, 2019, in exchange for $285,000 in cash. The subsidiary’s stockholders’ equity accounts totaled $326,000, and the noncontrolling interest had a fair value of $95,000 on that day. However, a building (with a 12-year remaining life) in Helton’s accounting records was undervalued by $18,000.

Kelly assigned the remaining excess fair over book value to Helton’s patented technology (three-year remaining life).

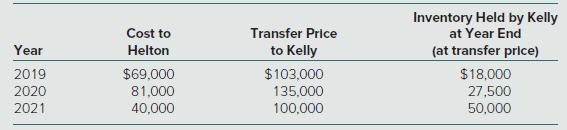

Helton sold inventory to Kelly as follows:

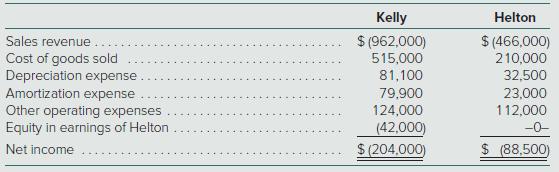

Following are selected separate account balances for these two companies for the year ended December 31, 2021. Credit balances are indicated by parentheses.

Prepare a consolidated income statement for Kelly Company and its subsidiary Helton for the year ended December 31, 2021. Include a proper title and line items allocating consolidated net income to the controlling and noncontrolling interests. Omit per share amounts.

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik