On January 1, 2016, Paxon Corporation acquired 90 percent of the outstanding common stock of Saxon Company

Question:

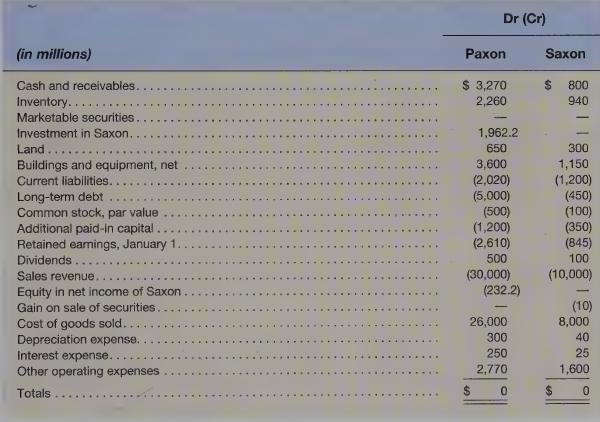

On January 1, 2016, Paxon Corporation acquired 90 percent of the outstanding common stock of Saxon Company for \($1,620\) million cash. The fair value of the 10 percent noncontrolling interest in Saxon was estimated to be \($180\) million at the date of acquisition. Paxon uses the complete equity method to report its investment. The trial balances of Paxon and Saxon at December 31, 2016, appear below:

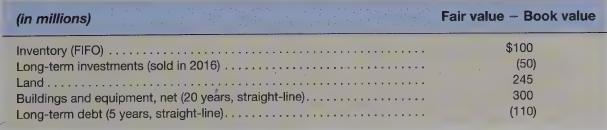

Several of Saxon’s assets and liabilities had fair values different from their book values at the acquisition date, as follows:

Required

a. Prepare a schedule computing the gain on acquisition.

b. Prepare a schedule calculating the equity in net income of Saxon for 2016, reported on Paxon’s books, and the noncontrolling interest in net income for 2016, to be reported on the consolidated income statement for 2016.

c. Prepare a working paper to consolidate the trial balances of Paxon and Saxon at December 31, 2016.

Step by Step Answer: