On January 2, 2016, Perkins Company acquired all of Sanders Corporation's stock for ($4,000,000) cash, when the

Question:

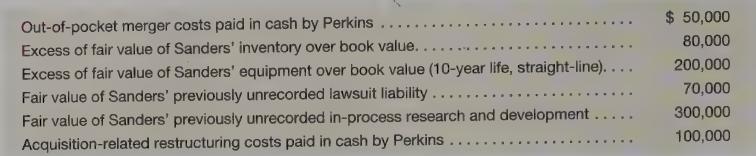

On January 2, 2016, Perkins Company acquired all of Sanders Corporation's stock for \($4,000,000\) cash, when the book value of Sanders' stockholders' equity was \($2,200,000\). Sanders reported \($500,000\) of net income and declared and paid appear below: dividends of \($150,000\) in 2016. Data related to the acquisition at January 2, 2016,

Sanders uses FIFO, and all of its beginning inventory was sold in 2016. The fair value of the previously unrecorded lawsuit liability increased to \($85,000\) by December 31, 2016, within the measurement period.

Impairment tests show \($100,000\) in impairment for the in-process R&D and no impairment for the goodwill during 2016.

Required

a. Prepare a schedule to compute Perkins’ equity in net income of Sanders Corporation for 2016 using the complete equity method, and prepare all entries related to the investment made by Perkins during 2016.

b. Compute the goodwill for this acquisition, after the measurement period adjustment.

c. Prepare the eliminating entries made in consolidation at December 31, 2016.

Step by Step Answer: