On November 15, 2016, a U.S. company takes delivery of merchandise costing C($1,000,000) from a Canadian supplier

Question:

On November 15, 2016, a U.S. company takes delivery of merchandise costing C\($1,000,000\) from a Canadian supplier and records an account payable. On the same date, the company enters a forward contract locking in the US. dollar purchase price of C\($1,000,000\), for delivery on April 15, 2017. The forward contract is closed and payment is made to the supplier on April 15, 2017. The company’s accounting year ends on December 31. Assuming the company still holds the merchandise at December 31, 2016, at what amount is the merchandise reported?

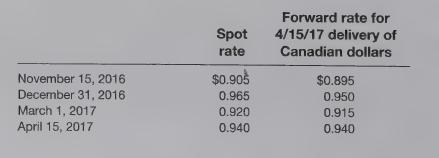

Use the following forward and spot prices for Canadian dollars (C\($)\) to answer this question. The prices are in U.S. dollars (\($/C$).

a. \($895,000\)

b. \($905,000\)

c. \($950,000\)

d. \($965,000\)

Step by Step Answer: