On September 1, 2016, Morton Industries, a U.S. company, decided to purchase merchandise from a supplier in

Question:

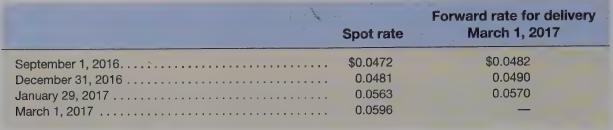

On September 1, 2016, Morton Industries, a U.S. company, decided to purchase merchandise from a supplier in Honduras for 10,000,000 lempira (L) at the end of January 2017. Morton plans to submit payment to the supplier on March 1, 2017, in lempira. Concurrently, Morton purchased L10,000,000 forward for delivery on March 1, 2017, for a total price of \($482,000.\) This forward contract qualifies as a hedge of a forecasted transaction. On January 29, 2017, Morton took delivery of the merchandise. On March 1, 2017, the forward contract was settled and payment was made to the supplier. Morton is a Plier ca company. On April 8, 2017, the merchandise was sold to a U.S. customer for \($600,000.\) Relevant exchange rates (\($/L)\) are as follows:

Required

Prepare the journal entries to record the above events, including December 31, 2016 adjusting entries.

Assume Morton records cost of goods sold at the time of sale.

Step by Step Answer: