On the 2017 consolidated working paper, eliminating entry (R) reduces Investment in Salem by a. ($3,100,000)

Question:

On the 2017 consolidated working paper, eliminating entry (R) reduces Investment in Salem by

a. \($3,100,000\)

b. \($5,200,000 \)

c. \($6,400,000 \)

d. \($8,000,000 \)

On January 1, 2014, Portland Company acquired all of Salem Company’s voting stock for \($16,000,000in\) cash. Some of Salem’s assets and liabilities at the date of purchase had fair values that differed from reported values, as follows:

Salem’s total stockholders’ equity at January 1, 2014, was \($4,000,000.\) It is now December 31, 2017 (four years later). Salem’s retained earnings reflect the accumulation of net income less dividends; there have been no other changes in its retained earnings. Salem does not report any other comprehensive income.

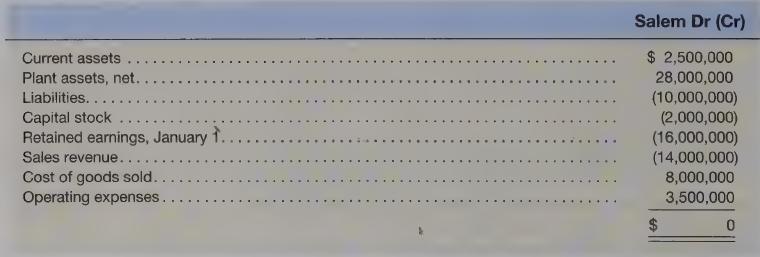

Cumulative goodwill impairment to the beginning of 2017 is \($2,000,000,\) Goodwill impairment for 2017 is \($500,000.\) Portland uses the complete equity method to account for its investment. The December 31, 2017, trial balance for Salem appears below.

Step by Step Answer: