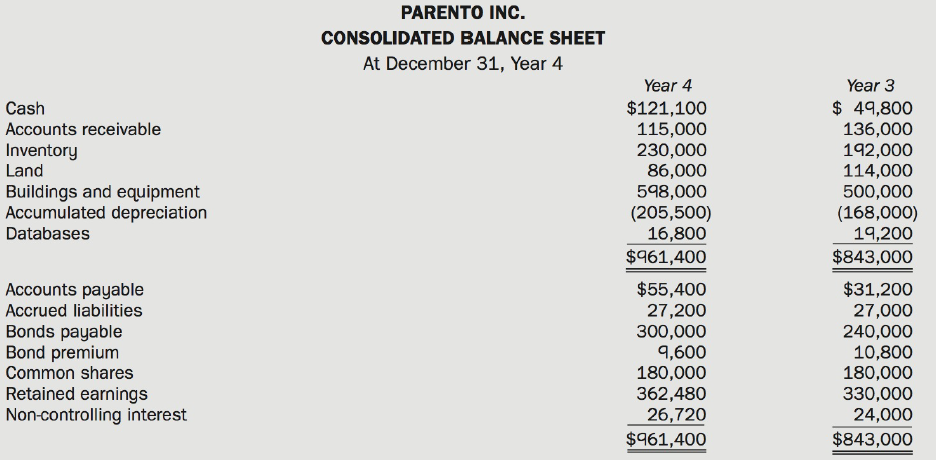

Parento Inc. owns 80% of Santana Corp. The consolidated financial statements of Parento follow: Parento Inc. purchased

Question:

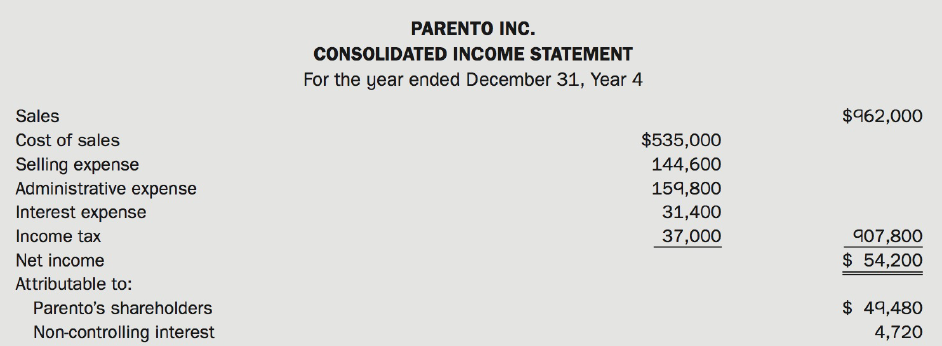

Parento Inc. owns 80% of Santana Corp. The consolidated financial statements of Parento follow:

Parento Inc. purchased its 80% interest in Santana Corp. on January 1, Year 2, for $114,000 when Santana had net assets of $90,000. The acquisition differential was allocated $24,000 to databases (10-year life), with the balance allocated to equipment (20-year life). Parento issued $60,000 in bonds on December 31, Year 4. Santana reported a net income of $26,000 for Year 4 and paid dividends of $10,000.

Selling and administrative expense includes the following:

Depreciation of buildings and equipment $37,500

Database amortization 2.400

Loss on land sale 2,500

Parento reported a Year 4 equity method income of $49,480 and paid dividends of $17,000.

Required:

(a) Prepare a consolidated cash flow statement for Year 4.

(b) Why are 100% of the dividends paid by Santana not shown as a cash outflow on the cash flow statement?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell