Ristoni Company is in the process of emerging from a Chapter 11 bankruptcy. It will apply fresh

Question:

Ristoni Company is in the process of emerging from a Chapter 11 bankruptcy. It will apply fresh start accounting as of December 31, 2024. The company currently has 30,000 shares of common stock outstanding with a $240,000 par value. As part of the reorganization, the owners will return 18,000 shares of this stock to the company. A retained earnings deficit balance of $330,000 exists at the time of this reorganization.

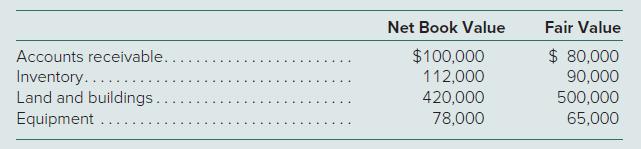

The company has the following asset accounts:

The company’s liabilities will be settled as follows. Assume that all notes will be issued at reasonable interest rates.

∙ Accounts payable of $80,000 will be settled with a note for $5,000. These creditors will also get 1,000 shares of the stock contributed by the owners.

∙ Accrued expenses of $35,000 will be settled with a note for $4,000.

∙ Note payable of $100,000 (due 2028) was fully secured and has not been renegotiated.

∙ Note payable of $200,000 (due 2027) will be settled with a note for $50,000 and 10,000 shares of the stock contributed by the owners.

∙ Note payable of $185,000 (due 2025) will be settled with a note for $71,000 and 7,000 shares of the stock contributed by the owners.

∙ Note payable of $200,000 (due 2026) will be settled with a note for $110,000.

The company has a reorganization value of $780,000. Prepare all journal entries for Ristoni so that the company can emerge from the bankruptcy proceeding.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik