Spindler, Inc. (a U.S.-based company), imports surfboards from a supplier in Brazil and sells them in the

Question:

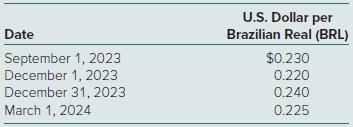

Spindler, Inc. (a U.S.-based company), imports surfboards from a supplier in Brazil and sells them in the United States. Purchases are denominated in terms of the Brazilian real (BRL). During 2023, Spindler acquires 200 surfboards at a price of BRL 1,600 per surfboard, for a total of BRL 320,000. Spindler will pay for the surfboards when it sells them. Relevant exchange rates are as follows:

a. Assume that Spindler acquired the surfboards on September 1, 2023, and made payment on December 1, 2023. What is the effect of the exchange rate fluctuations on reported income in 2023?b. Assume that Spindler acquired the surfboards on December 1, 2023, and made payment on March 1, 2024. What is the effect of the exchange rate fluctuations on reported income in 2023 and 2024?c. Assume that Spindler acquired the surfboards on September 1, 2023, and made payment on March 1, 2024. What is the effect of the exchange rate fluctuations on reported income in 2023 and in 2024?

Step by Step Answer:

Fundamentals Of Advanced Accounting

ISBN: 9781266268533

9th International Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik