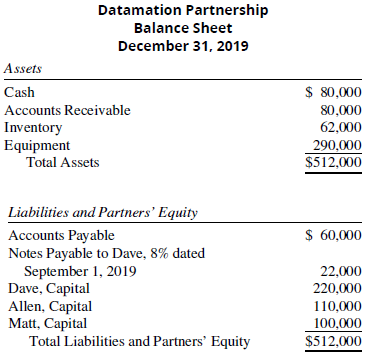

The December 31, 2019, balance sheet of the Datamation Partnership is shown below. Dave, Allen, and Matt

Question:

The December 31, 2019, balance sheet of the Datamation Partnership is shown below.

Dave, Allen, and Matt share profits and loses in the ratio of 50:30:20. The inventory on December 31 has a fair value of $68,000; accrued interest on the note payable to Dave is to be recognized as of December 31. The book values of all the other accounts are equal to their fair values. Allen withdrew from the partnership on December 31, 2019.

Required:

Prepare the journal entry or entries to record the withdrawal of Allen, given each of the following situations. Assume that the bonus method is used to account for the withdrawal.

1. Allen receives $36,624 cash and a $75,000 note from the partnership for his interest.

2. Matt purchases Allen?s interest for $110,000.

3. The partnership gives Allen $35,000 cash and equipment with a book value and a fair value of $90,000 for his interest.

4. The partnership gives Allen $100,000 cash for his interest.

5. Allen sells one-fourth of his interest to Dave for $40,000 and three-fourths to Matt for $90,000.

Step by Step Answer: