The Mcquire Company is considering acquiring 100% of the Sosa Company. The management of Mcquire fears that

Question:

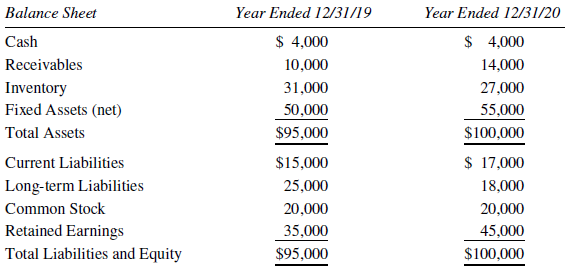

The Mcquire Company is considering acquiring 100% of the Sosa Company. The management of Mcquire fears that the acquisition price may be too high. Condensed financial statements for Sosa Company for the current year are as follows:

Income Statement ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ?2020Revenues..........................................$100,000Cost of Goods Sold..............................40,000Gross Margin........................................60,000Operating Expenses............................35,000Pretax Income......................................25,000Income Tax Expense...........................10,000Net Income...........................................15,000

You believe that Sosa might be currently acquired at a price resulting in a price to earnings (P/E) ratio of 8 to 12 times. Also, the fair market value of Sosa?s net assets is approximately $105,000, and the difference between book value and the value implied by the purchase price is due solely to depreciable assets with a remaining useful life of 10 years. Sosa Company is heavily involved in research and development of new baseball bats that enable the batter to hit the ball further. You estimate that $30,000 of the acquisition price might be classified as in-process R&D. Sosa?s net income is expected to grow an average of 10% per year for the next 10 years and remain constant there after.

Required:

A. If the acquisition occurs on January 1, 2021, determine the amount of income from Sosa Company that would be included in consolidated income assuming the following P/E ratios are used to determine the acquisition price, based on earnings for the year 2020. Suppose that the FASB revoked its requirement that in-process R&D be capitalized and amortized, as the result of extensive lobbying. Instead, in-process R&D will be expensed in the year of acquisition.

1. P/E ratio 10

2. P/E ratio 12

B. Now assume that FASB does require (as is currently the case at this writing) that in process R&D be capitalized (assume an amortization period of 20 years). How would your answer to part A change?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: