The partnership of Bauer, Ohtani, and Souza has elected to cease all operations and liquidate its business

Question:

The partnership of Bauer, Ohtani, and Souza has elected to cease all operations and liquidate its business property.

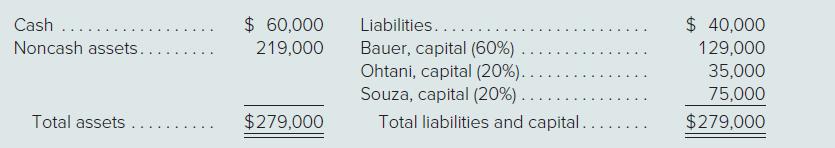

A balance sheet drawn up at this time shows the following account balances:

Part A

Prepare a predistribution plan for this partnership.

Part B

The following transactions occur in liquidating this business:

1. Distributed safe payments of cash immediately to the partners. Liquidation expenses of $8,000 are estimated as a basis for this computation.

2. Sold noncash assets with a book value of $94,000 for $60,000.

3. Paid all liabilities.

4. Distributed safe payments of cash again.

5. Sold remaining noncash assets for $51,000.

6. Paid actual liquidation expenses of $6,000 only.

7. Distributed remaining cash to the partners and closed the financial records of the business permanently.

Prepare a final statement of liquidation for this partnership using the predistribution plan to determine payments of cash to partners.

Part C

Prepare journal entries to record the liquidation transactions reflected in the final statement of liquidation.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik