The trial balances for Walla Corporation and Au Inc. at December 31, Year 4, just before the

Question:

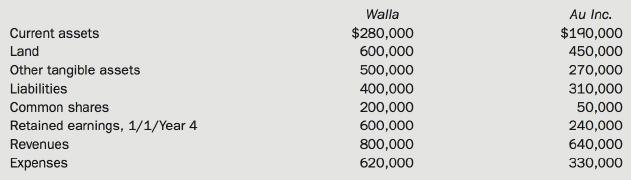

The trial balances for Walla Corporation and Au Inc. at December 31, Year 4, just before the transaction described below, were as follows:

On December 31, Year 4, Walla purchased all of the outstanding shares of Au Inc. by issuing 20,000 common shares with a market value of $36 per share. The carrying amounts of Au Inc.'s assets and liabilities were equal to fair value except for the following:

Fair Value

Land $500,000

Liabilities 330,000

What are the balances for the land, goodwill, investment in common shares, liabilities, common shares, and revenues after the transaction noted above on

(a) Walla's separate entity financial statements?

(b) Au Inc.'s separate entity financial statements?

(c) Walla's consolidated financial statements?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell