U.S. Industries has a subsidiary in Switzerland. The subsidiary's financial statements are maintained in Swiss francs (CHF).

Question:

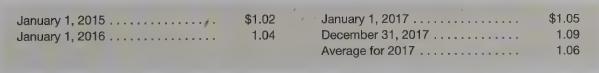

U.S. Industries has a subsidiary in Switzerland. The subsidiary's financial statements are maintained in Swiss francs (CHF). Exchange rates (\($/CHF)\) for selected dates are as follows:

The following items appear in the subsidiary’s trial balance at December 31, 2017:

1. Cash in bank, CHF4,000,000.

2. Inventory on LIFO basis, CHF3,000,000. The inventory cost consists of CHF1 ,000,000 acquired in January 2015 and CHF2,000,000 acquired in January 2017.

3. Machinery and equipment, CHF11 000,000. A review of the records indicates that the company bought equipment costing CHF5,000,000 in January 201520 percent of this was sold in January 2017) and additional equipment costing CHF7,000,000 in January 2016. Ignore accumulated depreciation.

4. Depreciation expense on machinery and equipment, CHF1,100,000 (depreciated over ten years, straight-line basis).

Required

Calculate the dollar amount for each of the above items, assuming the functional currency of the Swiss subsidiary is

(a) the U.S. dollar and

(b) the Swiss franc.

Step by Step Answer: