Asda is a U.K. supermarket chain that is a subsidiary of Wal-Mart Inc., a U.S. company. Wal-Mart's

Question:

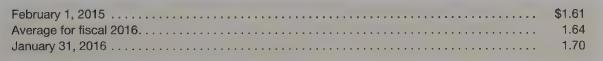

Asda is a U.K. supermarket chain that is a subsidiary of Wal-Mart Inc., a U.S. company. Wal-Mart's fiscal year ends January 31. On Feb- ruary 1, 2015, Asda reports facilities with original cost of 30 million and accumulated depreciation of 15 million in its noncurrent assets, as follows: Buildings acquired at a cost of 25 million when the exchange rate was \($1.50/,\) with accumulated depreciation of 12 million. The buildings are being depreciated on a straight-line basis over 25 years. Equipment acquired at a cost of 5 million when the exchange rate was \($1.40/,\) with accumulated depreciation of 3 million. The equipment is being depreciated on a straight-line basis over 10 years. Additional exchange rates:

Asda still holds these facilities at January 31, 2016.

Required

a. Assume that Asda’s functional currency is the pound. Calculate Asda’s translated facilities, at cost, and related accumulated depreciation, at January 31, 2016, and its translated depreciation expense for fiscal 2016.

b. Now assume that Asda’s functional currency is the U.S. dollar. Calculate Asda’s remeasured facilities, at cost, and related accumulated depreciation, at January 31, 2016, and its remeasured depreciation expense for fiscal 2016.

Step by Step Answer: