Using the information presented in Problem 7-10 prepare a consolidated financial statements workpaper for the year ended

Question:

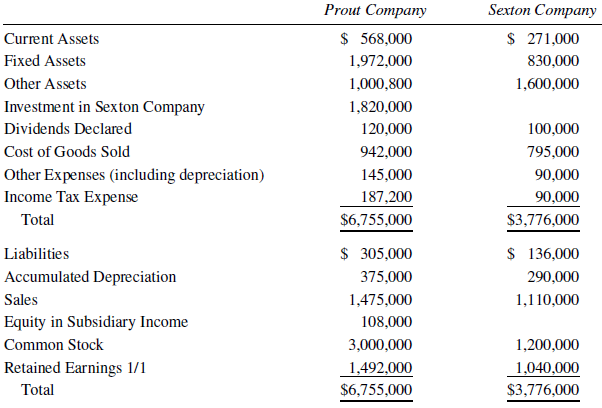

Using the information presented in Problem 7-10 prepare a consolidated financial statements workpaper for the year ended December 31, 2020, using the trial balance format.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Transcribed Image Text:

Prout Company Sexton Company Current Assets $ 568,000 $ 271,000 Fixed Assets 1,972,000 830,000 Other Assets 1,000,800 1,600,000 Investment in Sexton Company 1,820,000 Dividends Declared 120,000 100,000 Cost of Goods Sold 942,000 795,000 Other Expenses (including depreciation) Income Tax Expense 145,000 90,000 187,200 90,000 Total $6,755,000 $3,776,000 Liabilities $ 305,000 $ 136,000 Accumulated Depreciation 375,000 290,000 Sales 1,475,000 1,110,000 Equity in Subsidiary Income 108,000 Common Stock 3,000,000 1,200,000 Retained Earnings 1/1 1,492,000 $6,755,000 1,040,000 Total $3,776,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (12 reviews)

Prout Company and Subsidiary Consolidated Statements Workpaper FYE December 31 2020 Prout Sexton Eli...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Using the information presented in this chapter, explain why farmers spray water above and on their fruit trees on still nights when they know the temperature is going to drop below 0C.

-

In the year ended December 31 2017 Hexham Inc Hexham reported net income of 5 100 000 which included a writeoff of 1 377 000 of company assets During 2017 accounts receivable increased by 137 700...

-

The following information was available for the year ended December 31, 2013 Required: a. Calculate the inventory turnover for 2013. b. Calculate the number of days sales in inventory for 2013, using...

-

Answer the Multple Choice Questions and the code for problem 6in the end PROBLEM 1: General UNIX 1. What is UNIX? a) an operating system b) a text editor c) programming language d) software program...

-

Suppose that the fatigue data for the brass alloy in Problem 8.18 were taken from torsional tests, and that a shaft of this alloy is to be used for a coupling that is attached to an electric motor...

-

A major fast-food company is running a promotion for childrens meals for which it offers a Sharky toy. A single order will be placed for the toys. Each toy costs $0.50, and any unsold toys will have...

-

explain the importance of risk and crisis management for sports businesses;

-

The post-closing trial balance for Bugeja Co. is shown on page 349. The subsidiary ledgers contain the following information: (1) accounts receivable?? B. Cordelia $2,500, I. Togo $7,500, T. Dudley...

-

3. Understanding the IRR and NPV The net present value (NPV) and internal rate of return (IRR) methods of investment analysis are interrelated and are sometimes used together to make capital...

-

Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are income statements and balance sheets for Cisco Systems. Cisco Systems Consolidated Statements of...

-

Pinta Company, a forklift manufacturer, owns 80% of the voting stock of Standard Company. On January 1, 2019, Pinta Company sold forklifts to Standard Company for $400,000. The forklifts, which...

-

Pomeroy Corporation owns an 80% interest in Sherer Company and a 90% interest in Tampa Company. On January 2, 2019, Tampa Company sold equipment with a book value of $600,000 to Sherer Company for...

-

Using the data in E 8 and the average costing method, determine the cost per equivalent set for August. Assume equivalent sets are 16,900 for direct materials costs and 17,039 for conversion costs.

-

Write a program loop, using a pointer and a counter, that dears i'o 0 the contents of hexadecimal locations 500 through 5FF. Write a program to multiply two positive numbers by a repeated addition...

-

entries. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are...

-

APA formatting : Take the information below and put it into correct APA format. Journal Article (5 points) Authors: William R. Johnson, Cynthia E. Hernandez, Jamal M. Wilson. Year published: 2019....

-

Gulf Shore Lawn and Garden Maintenance provides two general outdoor services: lawn maintenance and garden maintenance. The company charges customers $18.0 per hour for each type of service, but lawn...

-

Two level sections of an east highway (G=0) are to be connected. Currently, the two sections of highway are seperated by a 4000-ft (horizontal distance), 2% grade. The westernmost section of highway...

-

Which of the following pairs are ketoenol tautomers? a. b. c. d. e. CH;CH,CH=CHCH,OH and CH;CH,CH,CH,CH

-

Should we separate the debt and equity features of convertible debt? Team 1: Pro separation: Present arguments in favor of separating the debt and equity features of convertible debt. Team 2: Against...

-

The partnership of Ace, Ben, Cid, and Don is dissolved on January 5, 2011, and the account balances at June 30, 2011, after all non-cash assets are converted into cash, are as follows: 1. The...

-

The partnership of Denver, Elsie, Fannie, and George is being liquidated over the first few months of 2011. The trial balance at January 1, 2011, is as follows: 1. The partners agree to retain...

-

The assets and equities of the Quen, Reed, and Stacy partnership at the end of its fiscal year on October 31, 2011, are as follows: The partners decide to liquidate the partnership. They estimate...

-

A single taxpayer who makes $34,024 per year in gross employment income has an 17 year old son who has a mental infirmity (but is not eligible to claim the disability tax credit). He pays $3,219 per...

-

The trial balance of Oriole Company at the end of its fiscal year, August 31, 2017, includes these accounts: Beginning Inventory $18,870; Purchases $224,790; Sales Revenue $204,200; Freight-In...

-

Question 9 5 pts Depreciation expense $4,000 Add $4,000 to operating Subtract $4,000 to operating Question 10 5 pts Issued bonds for $6,000 o Operating O Investing Financing

Study smarter with the SolutionInn App