a. If Solow growth rate shocks do largely explain business fluctuation, while the aggregate demand curve mostly

Question:

a. If Solow growth rate shocks do largely explain business fluctuation, while the aggregate demand curve mostly stays fixed, then should prices be higher than usual or lower than usual during a recession?

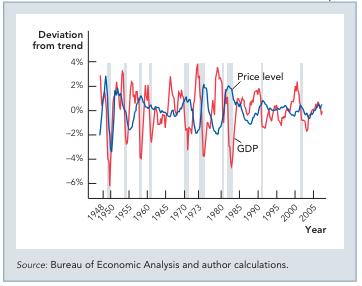

b. The following chart portrays historical U.S.

data on the relationship between the price level and real GDP. If you take a look at the big swings in the 1970s and early 1980s, especially during recessions, do the data roughly suggest that growth rate shocks or aggregate demand shocks were the primary disturbance? Lo1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: