Lets look at the Federal Reserves dilemma when theres a positive shock to the Solow growth rate.

Question:

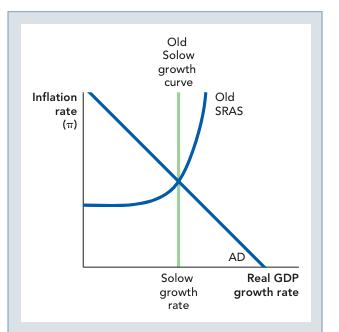

Let’s look at the Federal Reserve’s dilemma when there’s a positive shock to the Solow growth rate. We’ll consider the reverse of Figures 33.3 and 33.4.

a. In the following figure, illustrate the effect of this positive Solow growth shock, ignoring the possible effect of sticky wages and prices.

b. If the central bank kept AD fixed, would inflation be higher or lower after this positive real shock? Would real growth be higher or lower after this positive real shock?

c. If the central bank wants to return inflation to its old level, should it raise money growth or lower it? pg65

d. If the central bank wants to return real growth to its old level, should it raise money growth or lower it?

e. Economists say that central bankers face a “cruel trade-off” between inflation and real growth when a Solow growth shock hits.

Do your answers to parts c and d fit in with this theory?

Step by Step Answer: