Lets reenact a simplified version of the 19811982 Volcker disinflation. Expected inflation and actual inflation are both

Question:

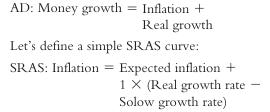

Let’s reenact a simplified version of the 1981–1982 Volcker disinflation. Expected inflation and actual inflation are both 10%, real growth is 3%, and to keep it simple, assume that velocity growth is zero. (Historical note: In fact, velocity growth shifted quite a lot during this period, which made Volcker’s job harder than in this problem. Otherwise, the numbers are close to the historical facts.) Thus, we have

Notice that this equation gives a positive relationship between inflation and real growth for a fixed Solow growth rate and expected inflation rate. pg65

a. First, let’s calculate how fast the money supply grew back when inflation was 10%

in 1980 and real growth was at the Solow rate of 3%. How fast did the money supply grow at this point, before Volcker started fighting inflation? (Hint: Use the AD equation.)

b. Now, let’s calculate how fast Volcker will let the money supply grow in the long run, after he pulls inflation down to 4% per year. Remember, he’ll assume that in the long run, the economy will just grow at the Solow growth rate. (Hint: Use AD again.)

c. In the short run, when Volcker cuts money growth to the rate you calculated in part

b, the economy won’t grow at the Solow rate.

Instead, real output will grow at whatever rate the SRAS dictates. In terms of algebra, this means you have to combine SRAS and AD; it’s a system of two equations and two unknowns: inflation and real growth. You know the values of money growth, expected inflation, and the Solow growth rate already.

In the short run, what will real growth and inflation be?

Step by Step Answer: