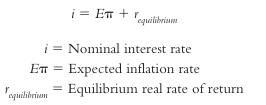

The Fisher effect says that nominal interest rates will equal expected inflation plus the real equilibrium rate

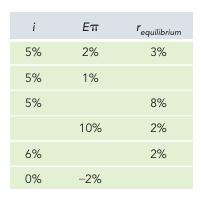

Question:

The Fisher effect says that nominal interest rates will equal expected inflation plus the real equilibrium rate of return: L02

Economists and Wall Street experts often use the Fisher effect to learn about economic variables that are hard to measure because when the Fisher effect holds, if we know any two of the three items in the equation, we can calculate the third. Sometimes, for example, economists are trying to estimate what investors expect inflation is going to be over the next few years, but they only have good estimates of nominal interest rates and the equilibrium real rate. Other times, they have good estimates of expected inflation and today’s nominal interest rates, and want to learn about the equilibrium real rate. Let’s use the Fisher effect just like the experts do: Use two known values to learn about the unknown third one. L02

Step by Step Answer: