Suppose that a set of assets are correctly priced by a stochastic discount factor (M). An economist

Question:

Suppose that a set of assets are correctly priced by a stochastic discount factor \(M\). An economist uses a false asset pricing model in which the stochastic discount factor is a random variable \(Y . M\) and \(Y\) have the same mean.

(a) Show that the false model correctly prices a riskless asset.

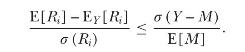

(b) In general the false model misprices risky assets. However, if \(Y\) moves closely with \(M\), the mispricing cannot be very large. Define "Jensen's alpha" for risky asset \(i\) as the difference between the true expected return, \(\mathrm{E}\left[R_{i}ight]\), and the expected return implied by the false model, \(\mathrm{E}_{Y}\left[R_{i}ight]\). Show that Jensen's alpha per unit of standard deviation must satisfy the inequality

(c) You find an asset for which this inequality holds as an equality. What does this imply about the asset's return?

(d) How might you use the formula in part (b) to respond to the Roll critique, discussed in section 3.3.3?

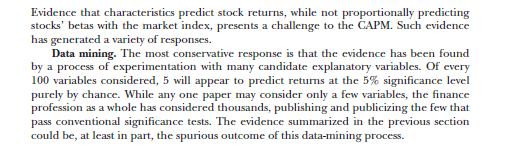

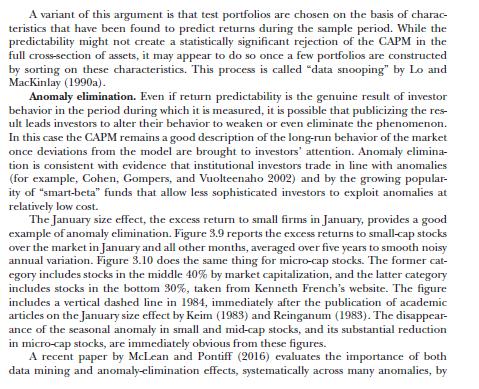

Data from section 3.3.3

Step by Step Answer:

Financial Decisions And Markets A Course In Asset Pricing

ISBN: 9780691160801

1st Edition

Authors: John Y. Campbell