A swap bank quotes the following pricing schedule for a Polish zloty coupon (interest rate) swap. This

Question:

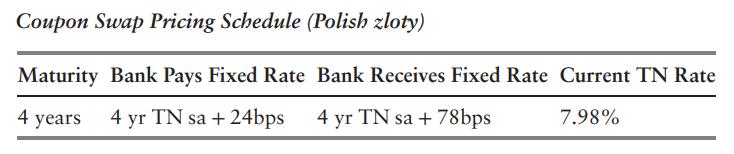

A swap bank quotes the following pricing schedule for a Polish zloty coupon (interest rate) swap.

This schedule assumes nonamortizing debt and semiannual rates (sa). Quotes are against 6-month LIBOR Polish zloty flat. TN = Polish Treasury Note rate.

a. Ford Motor Company has 4-year floating rate zloty debt at 6-month LIBOR plus 45 bps. Ford wants to swap into fixed rate zloty debt. Describe Ford’s floating-for-fixed zloty coupon swap.

b. Polish Motors (PM) has 4-year fixed rate zloty debt at 9.83 percent (BEY). PM wants to swap into floating rate zlotys. Describe PM’s fixed-for-floating zloty coupon swap.

c. What does the swap bank gain from these transactions?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: