Assume all the same debt and equity values for Sasquatch Corporation in Problem 4.9 , with the

Question:

Assume all the same debt and equity values for Sasquatch Corporation in Problem 4.9 , with the sole exception that both A-shares and B-shares have the same voting rights—5 votes per share.

a. What proportion of the total long-term capital has been raised by A-shares?

b. What proportion of voting rights is represented by A-shares?

c. What proportion of the dividends should the A-shares receive?

Data form Problem 4.9

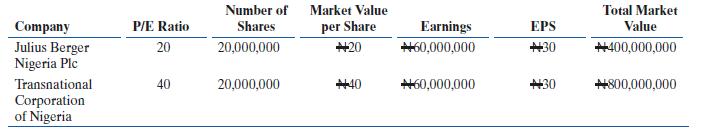

Transnational Corporation of Nigeria. During the 1960s, many conglomerates were created by firms that were enjoying a high price/earnings ratio (P/E). These firms then used their highly valued stock to acquire other firms that had lower P/E ratios, usually in unrelated domestic industries. Conglomerates went out of fashion during the 1980s when their P/E ratios significantly declined, thus making it more difficult to find other firms with lower P/E ratios to acquire. During the 1990s, the same acquisition strategy was possible for firms located in countries where high P/E ratios were common compared to firms in other countries where low P/E ratios were common. Consider the two hypothetical firms shown in the following table:

Transnational Corporation of Nigeria wants to acquire Julius Berger Nigeria Plc. It offers 7,500,000 shares of Transnational Corporation of Nigeria, with a current market value of N300,000,000 and a 12% premium on Julius Berger Nigeria Plc’s shares, for all of Julius Berger’s shares.

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292445960

16th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett