EuroVirtuals EPS Sensitivity to Exchange Rates (A). On January 15, 2015 the Swiss National Bank (SNB) decided

Question:

EuroVirtual’s EPS Sensitivity to Exchange Rates (A).

On January 15, 2015 the Swiss National Bank (SNB)

decided to unpeg the franc, which was fixed at CHF1.20/€

since 2011. Suppose the SNB was to reverse its decision and readopt the previous peg. How would this affect the consolidated EPS of EuroVirtual if all other exchange rates, tax rates, and earnings remain unchanged?

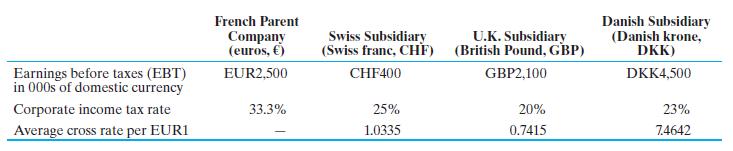

In addition to its home operations in France, EuroVirtual owns and operates subsidiaries in Switzerland, the United Kingdom, and Denmark. It has 650,000 shares currently outstanding on the pan-European stock exchange: Euronext. The following table summarizes the business performance of EuroVirtual:

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292097879

14th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett