EuroVirtuals Global Taxation and Effective Tax Rate. All MNEs attempt to minimize their global tax liabilities. Return

Question:

EuroVirtual’s Global Taxation and Effective Tax Rate.

All MNEs attempt to minimize their global tax liabilities.

Return to the original set of baseline assumptions and answer the following questions regarding Euro Virtual’s global tax liabilities:

a. What is the total corporate income tax that Euro-

Virtual pays for all its operations in euros?

b. What is its effective tax rate (total taxes paid as a percentage of pre-tax earnings)?

c. Suppose the United Kingdom decides to reduce its corporate tax rate to 10%, leading to a rise in EuroVirtual’s British subsidiary’s earnings before tax to GBP3,000,000. What would be the impact on EuroVirtual’s EPS?

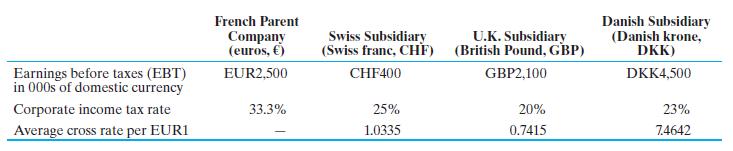

In addition to its home operations in France, EuroVirtual owns and operates subsidiaries in Switzerland, the United Kingdom, and Denmark. It has 650,000 shares currently outstanding on the pan-European stock exchange: Euronext. The following table summarizes the business performance of EuroVirtual:

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292097879

14th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett