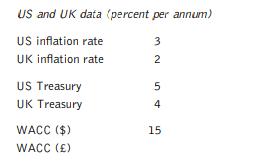

Foreign currency conversion of free-cash flows Consider the data below on the United States and the UK

Question:

Foreign currency conversion of free-cash flows Consider the data below on the United States and the UK (percent per annum). Assume the required real rates of return are the same.

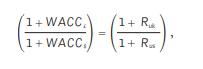

a If the WACC in US dollars is 15 percent, what is the WACC in pounds sterling, given the above data? Recall that the conversion rule for the WACC is:

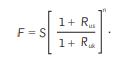

and the interest rate parity rule for forecasting the exchange rate is:

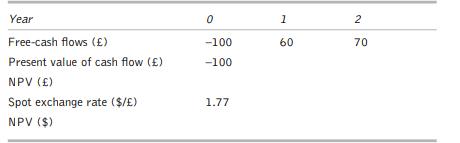

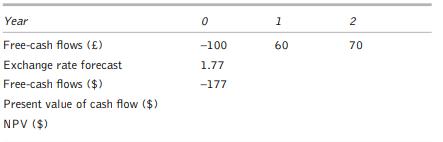

Now consider the estimated free-cash flows in British pounds of a two-year project by a UK subsidiary:

Method A

● Discount foreign currency flows to the present at the foreign currency discount rate, then convert the NPV in FOREX to home currency at the spot rate.

Method B

● Convert foreign currency cash flows to home currency, and discount to the present at the home currency discount rate.

b On the basis of the inflation rate, interest rate, and weighted average cost of capital (WACC), should the US parent firm undertake this project? (That is, compute the net present value (NPV) in dollars using the two methods.)

Step by Step Answer: