International taxation (I) a The headquarters of your computer company is located in Texas, but you have

Question:

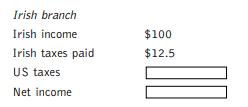

International taxation (I) a The headquarters of your computer company is located in Texas, but you have a branch for assembly and re-export to Europe that is located in Ireland, where the corporate tax rate is 12.5 percent for foreign companies. Fill in the blanks in the data below on international taxation. Explain your result:

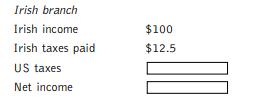

b The headquarters of your computer company is still located in Texas, but now you export computer parts for assembly to an Irish-incorporated subsidiary that reinvests its profits in Ireland. Fill in the blanks in the data below. Explain your result:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: