International taxation (II) As Treasurer of US Exports Inc., you have set up an FSC in the

Question:

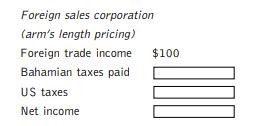

International taxation (II) As Treasurer of US Exports Inc., you have set up an FSC in the Bahamas for the export to Europe of your US manufactures, and are applying arm’s length pricing of your goods “shipped” to the FSC. Your exempt foreign trade income from the sale or lease of export property is indicated below:

a Fill in the blanks above, recalling that the portion of foreign trade income exempt from taxes is 34 percent, and the Bahamas has no income tax.

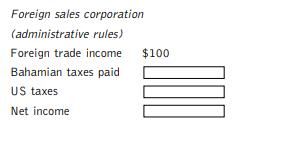

b In the second case, your FSC is set up according to special administrative rules, which exempt 17/23 of foreign trade income from US taxation. Fill in the blanks below and explain your answer:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: