It was January 2002, and Toyota Motor Europe Manufacturing (TMEM) had a problem. More specifically, Mr. Toyoda

Question:

It was January 2002, and Toyota Motor Europe Manufacturing (TMEM) had a problem. More specifically, Mr.

Toyoda Shuhei, the new President of TMEM, had a problem.

He was on his way to Toyota Motor Company’s (Japan)

corporate offices outside Tokyo to explain the continuing losses of the European manufacturing and sales operations.

The CEO of Toyota Motor Company, Mr. Hiroshi Okuda, was expecting a proposal from Mr. Shuhei to reduce and eventually eliminate the European losses. The situation was intense given that TMEM was the only major Toyota subsidiary suffering losses.

Toyota and Auto Manufacturing Toyota Motor Company was the number one automobile manufacturer in Japan, the third largest manufacturer in the world by unit sales (5.5 million units or one auto every six seconds), but number eight in sales in Continental Europe.

The global automobile manufacturing industry had been experiencing, like many industries, continued consolidation in recent years as margins were squeezed, economies of scale and scope pursued, and global sales slowed.

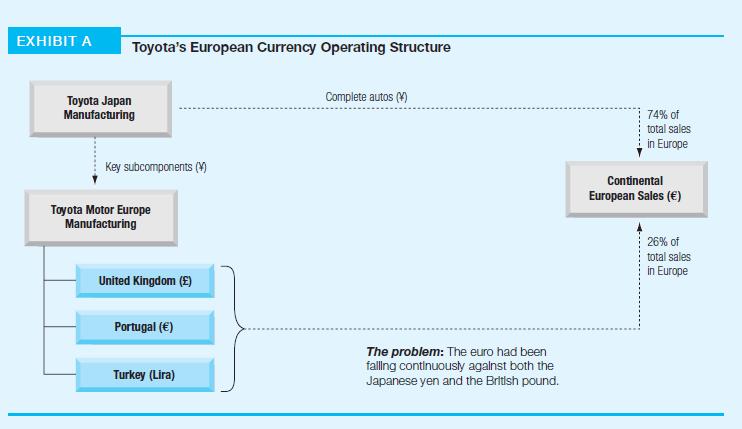

Toyota was no different. It had continued to rationalize its manufacturing along regional lines. Toyota had continued to increase the amount of local manufacturing in North America. In 2001, over 60% of Toyota’s North American sales were locally manufactured. But Toyota’s European sales were nowhere close to this yet. Most of Toyota’s automobile and truck manufacturing for Europe was still done in Japan. In 2001, only 24% of the autos sold in Europe were manufactured in Europe (including the United Kingdom). The remainder was imported from Japan (see Exhibit A).

Toyota Motor Europe sold 634,000 automobiles in 2000. This was the second largest foreign market for Toyota, second only to North America. TMEM expected significant growth in European sales, and was planning to expand European manufacturing and sales to 800,000 units by 2005. But for fiscal 2001, the unit reported operating losses of ¥9.897 billion ($82.5 million at ¥120/$). TMEM had three assembly plants in the United Kingdom, one plant in Turkey, and one plant in Portugal. In November 2000, Toyota Motor Europe announced publicly that it would not generate positive profits for the next two years due to the weakness of the euro.

Toyota had recently introduced a new model to the European market, the Yaris, which was proving very successful.

The Yaris, a super-small vehicle with a 1,000cc engine, had sold more than 180,000 units in 2000. Although the Yaris had been specifically designed for the European market, the decision had been made early on to manufacture it in Japan.

Currency Exposure The primary source of the continuing operating losses suffered by TMEM was the falling value of the euro. Over the recent two-year period, the euro had fallen in value

against both the Japanese yen and the British pound.

As demonstrated in Exhibit A, the cost base for most of the autos sold within the Continental European market was the Japanese yen. Exhibit B illustrates the slide of the euro against the Japanese yen.

As the yen rose against the euro, costs increased significantly when measured in euros. If Toyota wished to preserve its price competitiveness in the European market, it had to absorb most of the exchange rate changes and suffer reduced margins on both completed cars and key.......

Mini-Case Questions 1. Why do you think Toyota waited so long to move much of its manufacturing for European sales to Europe?

2. If the British pound were to join the European Monetary Union would the problem be resolved?

How likely do you think this is?

3. If you were Mr. Shuhei, how would you categorize your problems and solutions? What was a short-term problem? What was a long-term problem?

4. What measures would you recommend that Toyota Europe take to resolve the continuing operating losses?

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292097879

14th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett