Kaili Razor (B). Encouraged by the results in the previous problems analysis, corporate management of Supermax wishes

Question:

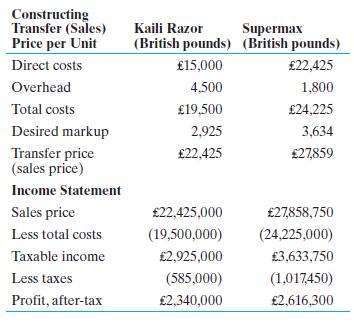

Kaili Razor (B). Encouraged by the results in the previous problem’s analysis, corporate management of Supermax wishes to continue to reposition profit in China. It is, however, facing two constraints. First, the final sales price in Great Britain must be 28,300 or less to remain competitive. Second, the British tax authorities—working with Supermax’s cost accounting staff—have established a maximum transfer price allowed (from China) of 24,500. What combination of markups do you recommend for Supermax to institute? What is the impact of this repositioning on consolidated profits on after-tax and total tax payments?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Multinational Business Finance

ISBN: 9781292270081

15th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett

Question Posted: