Kashmiri is the largest and most successful specialty goods company based in Bangalore, India. It has not

Question:

Kashmiri is the largest and most successful specialty goods company based in Bangalore, India. It has not yet entered the North American marketplace but is considering West Gas finds that it can finance in the domestic U.S. capital market at the following rates. Both debt and equity would have to be sold in multiples of \($20\) million, and these cost figures show the component costs of debt and equity, if raised half by equity and half by debt. A London bank advises West-Gas that U.S. dollars could be raised in Europe at the following costs, also in multiples of \($20\) million, while maintaining the 50/50 capital structure. Each increment of cost would be influenced by the total amount of capital raised. That is, if WestGas first borrowed \($20\) million in the European market at 6% and matched this with an additional \($20\) million of equity, additional debt beyond this amount would cost 12% in the U.S. and 10% in Europe. The same relationship holds for equity financing.

establishing both manufacturing and distribution facilities in the U.S. through a wholly owned subsidiary.

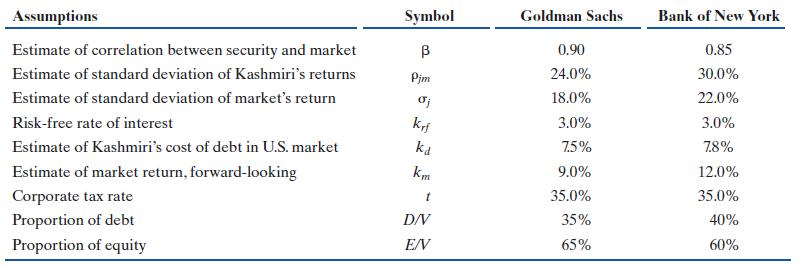

It has approached two different investment banking advisors, Goldman Sachs and Bank of New York, for estimates of what its costs of capital would be several years into the future when it planned to list its American subsidiary on a U.S. stock exchange.

Using the assumptions by the two different advisors (shown in the table at the bottom of this page), calculate the prospective costs of debt, equity, and the WACC for Kashmiri (U.S.).

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292445960

16th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett