Penang Stove Company manufactures propane kitchen stoves for sale to retail outlets in Malaysia and, through a

Question:

Penang Stove Company manufactures propane kitchen stoves for sale to retail outlets in Malaysia and, through a wholly owned distribution subsidiary in neighboring Thailand. Annual capacity of the Penang factory is 18,000 units per year, but present production is only 8,000 , of which 4,000 are sold in Malaysia and 4,000 are exported to Thailand. Income tax rates in both Malaysia and Thailand are \(30 \%\).

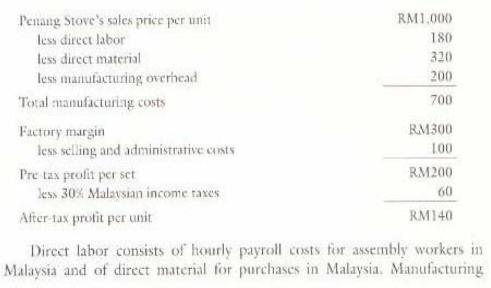

Within Malaysia, Penang Stove sells units to retail outlets for RM1,000 each. (RM stands for Malaysian ringgits.) After-tax profit is RM140 per srove, calculated as follows:

overhead is a fixed cost that includes production-line supervision and depreciation. Selling and administrative costs are fixed expenses for management salaries, office expenses, and rent.

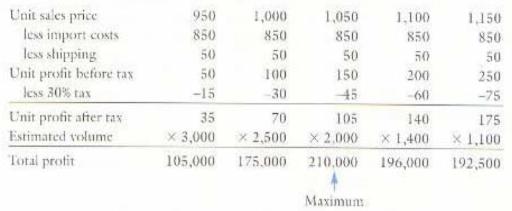

Penang Stove sells stoves to its Thai distriburion affiliate at a transfer price of RM850, this being Malaysia manufacturing cost of RM700 plus RM150 of margin. Transportation and distribution costs, paid by the Thai subsidiary, add RM50 to the unit cost in Thailand. The stoves are resold to Thai retailers for the Malaysian ringgit equivalent of RM1,050. This Thai sales price was established after estimating elasticiry of demand in Thailand as follows: (All prices are in Malaysia ringgits. Thai taxes are credited against Malaysian tax liabilities.)

In this calculation, Penang Stove assumed that unit demand in Thailand was a function only of the sales price. Hence it seemed self evident to Penang's management that a transfer price to Thailand of RM850 maximized the Thai contribution to profits at RM210,000 per year.

a. Is Penang Stove's present pricing strategy for Thailand optimal?

b. Assume Penang Stove wants to divide profits on export sales evenly between Malaysia and Thailand so as to avoid difficulties with either tax authority: What final transfer price and unit price in Thailand should the firm adopt for Thai sales?

c. If Malaysia's income tax rate remains \(30 \%\), but Thailand lowers its tax rate to \(20 \%\), should a new transfer price be adopted? What policy issues are involved?

Step by Step Answer:

Multinational Business Finance

ISBN: 9780201635386

9th Edition

Authors: David K. Eiteman, Michael H. Moffett, Arthur I. Stonehill, Denise Clinton