Cia. Sevilla de Olivos, S.A. (Sevilla Olive Company) sells containers of Spanish olives to its wholly owned

Question:

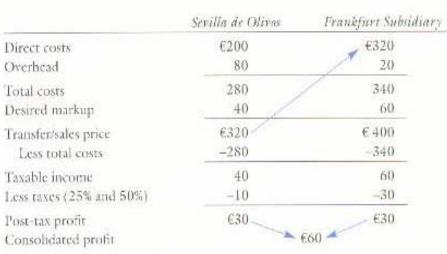

Cia. Sevilla de Olivos, S.A. (Sevilla Olive Company) sells containers of Spanish olives to its wholly owned distribution afriliate in Frankfurt, Germany. Spanish income tax rates are \(25 \%\) and German tax rares are \(50 \%\). All accounts are kept in curos. At present, profit per container is \(€ 60\), calculated as follows:

a. What happens to profits if Sevilla de Olivos' transfer price is increased \(12.5 \%\) to \(€ 360\) ?

b. What happens to profits if, after Sevilla de Olives increases its transfer price to \(€ 360\), German tax authorities disallow the new transfer price and impose the old \(£ 320\) price for German tax purposes?

Step by Step Answer:

Multinational Business Finance

ISBN: 9780201635386

9th Edition

Authors: David K. Eiteman, Michael H. Moffett, Arthur I. Stonehill, Denise Clinton