Singflux is a Singapore-based company that manufactures, sells, and installs water-treatment plants. On June 1, the company

Question:

Singflux is a Singapore-based company that manufactures, sells, and installs water-treatment plants. On June 1, the company sold a water-treatment plant to the City of Hiroshima, Japan, for installation in Hiroshima’s famous cherry blossom gardens. The sale was priced in yen at ¥100,000,000, with payment due in three months.

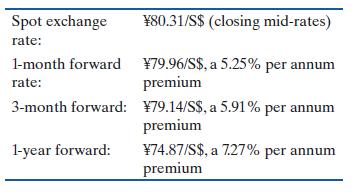

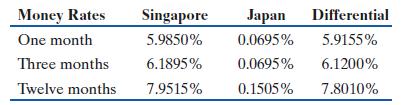

Note that the interest rate differentials vary slightly from the forward discounts on the yen because of time differences for the quotes. The spot ¥80.31/S\($,\) for example, is a mid-point range. On June 1, the spot yen traded in London from ¥80.36/S$ to ¥79.86/S\($.

Singflux’s\) Japanese competitors are currently borrowing from Japanese banks at a spread of one percentage point above the Japanese money rate.

Singflux’s weighted average cost of capital is 10%, and the company wishes to protect the Singapore dollar value of this receivable.

These 3-month options are available from Kokoda Bank: a call option on ¥100,000,000 at exercise price of ¥80.00/S\($:\) a 1% premium; or a put option on ¥100,000,000, at exercise price of ¥80.00/S\($:\) a 3% premium.

a. What are the costs and benefits of alternative hedges? Which would you recommend, and why?

b. What is the break-even reinvestment rate when comparing forward and money market alternatives?

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292445960

16th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett