Kraftangan Ornamentals, a Malaysian, 100% privately-owned ornamentals company, has signed an agreement to acquire a 60% ownership

Question:

Kraftangan Ornamentals, a Malaysian, 100% privately-owned ornamentals company, has signed an agreement to acquire a 60% ownership share of Taiwan Ornamentals, a Taiwanbased, privately-owned ornamental company specializing in customized figurines from Thailand and Indonesia. The acquisition price is 9 million Taiwan dollars (TWD), payable in cash in three months.

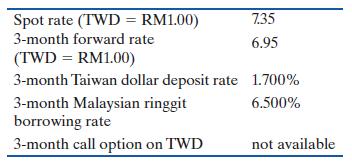

Ahmad Chik, the owner of Kraftangan Ornamentals, believes the Taiwan dollar will either remain stable or decline slightly over the next three months.

At the present spot rate of TWD7.35 = RM1.00, the amount of cash required is only RM1,224,490, but even this relatively modest amount will need to be borrowed personally by Ahmad Chik. The Taiwanese interest-bearing deposits by non-residents are regulated by the government and are currently set at 1.7% per year. He has a credit line with Malaysian Entrepreneurial Bank for RM1,224,490 with a current borrowing interest rate of 6.5% per year. He does not believe that he can calculate a credible weighted average cost of capital since the company is not listed and neither are his closest competitors.

Since the acquisition would use up all his available credit, he wonders if he should hedge the transaction exposure. He has the following quotes from the Malaysian Entrepreneurial Bank:

Analyze the cost and risks of each alternative, and then make a recommendation as to which alternative Ahmad Chik should choose.

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292445960

16th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett