The Equity. You have joined your friends at the local tavern, The Equity, for your weekly debate

Question:

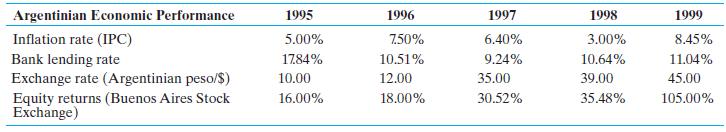

The Equity. You have joined your friends at the local tavern, The Equity, for your weekly debate on international finance. The topic this week is whether the cost of equity can ever be cheaper than the cost of debt. The group has chosen Argentina in the mid-1990s as a subject of the debate. One of the group members has torn out a table of data out of a book, which becomes the subject of the analysis.

Ven argues, “It’s all about expected versus delivered.

You can talk about what equity investors expect, but they often find that what is delivered for years at a time is so small—even sometimes negative—that in effect, the cost of equity is cheaper than the cost of debt.”

Arigashi interrupts, “But you’re missing the point. The cost of capital is what the investor requires in compensation for the risk taken going into the investment. If he doesn’t end up getting it, and that was happening here, then he pulls his capital out and walks.”

Babachuk is a theoretician. “Ladies, this is not about empirical results; it is about the fundamental concept of risk-adjusted returns. An investor in equities knows he will reap returns only after all compensation has been made to debt providers.

He is therefore always subject to a higher level of risk to his return than with debt instruments and, as the capital asset pricing model states, equity investors set their expected returns as a risk-adjusted factor over and above the returns to risk-free instruments.”

At this point, Ven and Arisgashi simply stare at Babachuk—pause—and order more drinks. Using the Argentinian data presented, comment on this week’s debate at The Equity.

Genedak-Hogan Use the next table to answer Problems 13.12 through 13.14. Genedak-Hogan (G-H) is an American conglomerate that is actively debating the impacts of international diversification of its operations on its capital structure and cost of capital.

The firm is planning on reducing consolidated debt after diversification.

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292270081

15th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett