Telascos Cost of Capital. Telasco is generally considered to be the largest privately held company in South-East

Question:

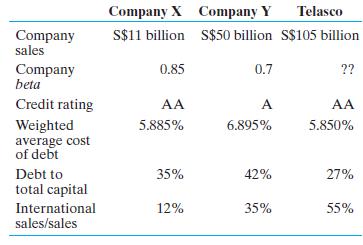

Telasco’s Cost of Capital. Telasco is generally considered to be the largest privately held company in South-East Asia. Headquartered in Singapore, the company has been averaging sales of over S$120 million per year over the past five years. Although the company does not have publicly traded shares, it is still extremely important for it to calculate its weighted average cost of capital properly in order to make rational decisions on new investment proposals. Assuming a risk-free rate of 2.50%, an effective tax rate of 17%, and a market risk premium of 6.50%, estimate the weighted average cost of capital first for companies X and Y, and then make a “guesstimate” of what you believe a comparable WACC would be for Telasco.

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292270081

15th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett