There was the short story, and the longer more complex story. Iceland had seen both. And what

Question:

There was the short story, and the longer more complex story. Iceland had seen both. And what was the moral of the story? Was the moral that it’s better to be a big fish in a little pond, or was it once burned twice shy, or something else?

Iceland was a country of only 300,000 people. It was relatively geographically isolated, but its culture and economy were heavily intertwined with that of Europe, specifically northern Europe and Scandinavia. A former property of Denmark, it considered itself both independent and yet Danish. Iceland’s economy was historically driven by fishing and natural resource development. Although not flashy by any sense of the word, they had proven to be solid and lasting industries, and in recent years, increasingly profitable.

At least that was until Iceland discovered “banking.”

The Icelandic Crisis: The Short Story Iceland’s economy had grown very rapidly in the 2000 to 2008 period. Growth was so strong and so rapid that inflation—

an ill of the past in most of the economic world—

was a growing problem. As a small, industrialized and open economy, capital was allowed to flow into and out of Iceland with economic change. As inflationary pressures rose, the Central Bank of Iceland had tightened monetary policy, interest rates rose. Higher interest rates attracted capital from outside Iceland, primarily European capital, and the banking system was flooded with capital. The banks in turn invested heavily in everything from real estate to Land Rovers (or Game Overs as they became known).

Then September of 2008 happened. The global financial crisis, largely originating in the United States and its real estate-securitized-mortgage-debt-credit-default-swap crisis brought much of the international financial system and major industrial economies to a halt. Investments failed—

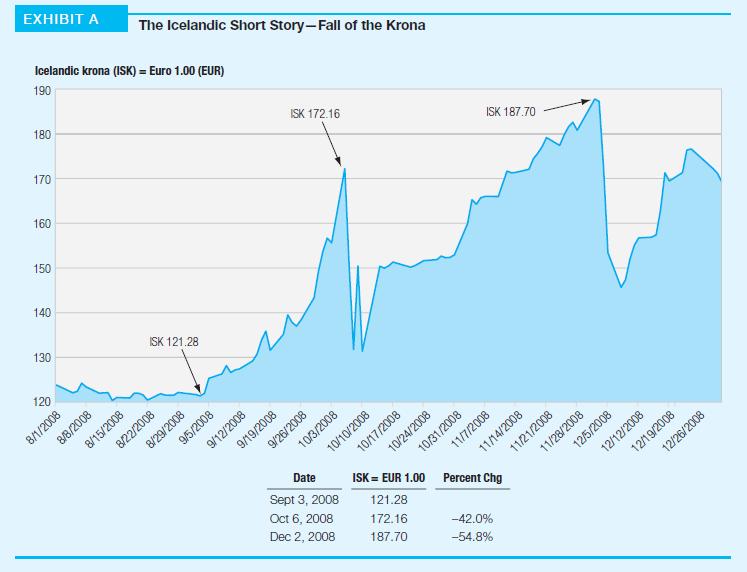

in the U.S., in Europe, in Iceland. Loans to finance those bad investments fell delinquent. The Icelandic economy and its currency—the krona—collapsed. As illustrated in Exhibit A, the Krona fell more than 40% against the euro in roughly 30 days, more than 50% in 90 days. Companies failed, banks failed, unemployment grew, and inflation boomed. A long, slow, and painful recovery began.

The Icelandic Crisis: The Longer Story The longer story of Iceland’s crisis has its roots in mid-

1990s, when Iceland—like many other major industrial economies—embraced privatization and deregulation.

The financial sector, once completely owned and operated by government, was privatized and largely deregulated by 2003. Home mortgages were deregulated in 2003; new mortgages required only a 10% down payment. Investment—

foreign direct investment (FDI)—flowed into Iceland rapidly. A large part of the new investment was in aluminum production, an energy-intensive process that

could utilize much of Iceland’s natural (natural after massive damn construction) hydroelectric power. But FDI of all kinds also flowed into the country, including household and business capital.

The new Icelandic financial sector was dominated by three banks—Glitnir, Kaupthing, and Landsbanki Islands. Their opportunities for growth and profitability seemed unlimited, both domestically and internationally.

Iceland’s membership in the European Economic Area (EEA) provided the Icelandic banks a financial passport to expand their reach throughout the greater European marketplace.

As capital flowed into Iceland rapidly in 2003–2006, the krona rose, increasing the purchasing power of Icelanders but raising concerns with investors and government.

Gross domestic product...........

Mini-Case Questions 1. Do you think a country the size of Iceland—a Lilliputian—

is more or less sensitive to the potential impacts of global capital movements?

2. Many countries have used interest rate increases to protect their currencies for many years. What are the pros and cons of using this strategy?

3. How does the Iceland story fit with our understanding of the Impossible Trinity? In your opinion, which of the three elements of the Trinity should Iceland have taken steps to control more?

4. In the case of Iceland, the country was able to sustain a large current account deficit for several years, and at the same time have ever-rising interest rates and a stronger and stronger currency. Then one day, it all changed. How does that happen?

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292097879

14th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett