Tuskeegee Airlines is a U.S.-based air freight firm with a wholly owned sub. sidiary in Hong Kong.

Question:

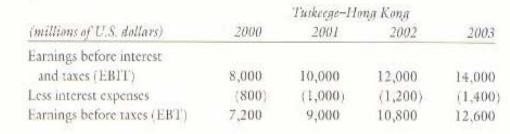

Tuskeegee Airlines is a U.S.-based air freight firm with a wholly owned sub. sidiary in Hong Kong. The subsidiary, Tuskecgee-Hong Kong, has just completed a long term planning report for the parent company in San Francisco, in which it has estimated the following expected carnings and payout rates for the years \(2000-2003\).

The current Hong Kong corporate tax rate on this catcgory of income is 16.5\%. Hong Kong imposes no withholding taxes on dividends remitted to U'S. investors (per the Hong Kong-United States bilateral tax treaty). The U.S. corporate income tax rate is \(35 \%\). The parent company wants to reparriate \(75 \%\) of net income as dividends annually:

a. Calculate the net income available for distribution by the Hong Kong subsidiary for the ycars 2000-2003.

b. What is the amount of the dividend which is expected to be remitted to the U.S. parent each year?

c. After gross-up for U.S. tax liability purposes, what is the total dividend after-tax (all Hong Kong and U.S. taxes) expected each year?

d. What is the effective tax rate on this foreign sourced income per year?

e. What is the effective tax rate if Hong Kong imposes a \(15 \%\) withholding tax?

f. Which withholding tax rate will make excess foreign tax credits equal to the U.S. tax liability?

Step by Step Answer:

Multinational Business Finance

ISBN: 9780201635386

9th Edition

Authors: David K. Eiteman, Michael H. Moffett, Arthur I. Stonehill, Denise Clinton