Stutz is a German-based company that manufactures electronic fuel-injection carburetor assemblies for several largc automobile companies in

Question:

Stutz is a German-based company that manufactures electronic fuel-injection carburetor assemblies for several largc automobile companies in Germany, including Mercedes, BMW, and Opel. The firm, like many firms in Germany today, is revising its financial policies in-line with the increasing degree of disclosure required by firms if they wish to list their shares publicly in or out of Germany.

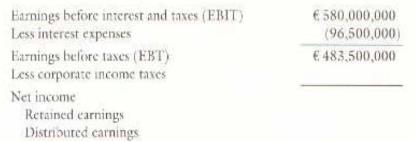

Stutz's primary problem at the moment is taxation. The German corporate income tax code applies a different income tax rate to income depending on whether it is retained ( \(45 \%\) ) or distributed to stockholders ( \(30 \%\) ).

a. If Stutz planned to distribute \(50 \%\) of its net income, what would be its total net income and total corporate tax bills?

b. If Stutz was attempting to choose between a \(40 \%\) payout rate and a \(60 \%\) payout rate to stockholders, what arguments and values would management use in order to convince stockholders which of the two payouts is in evervonc's best interest:

Step by Step Answer:

Multinational Business Finance

ISBN: 9780201635386

9th Edition

Authors: David K. Eiteman, Michael H. Moffett, Arthur I. Stonehill, Denise Clinton