ZNZ Petroleum is a U.S.-based multinational pecroleum and petrochemical exploration, production, and distribution company. ZNZ's subsidiary in

Question:

ZNZ Petroleum is a U.S.-based multinational pecroleum and petrochemical exploration, production, and distribution company. ZNZ's subsidiary in Zairc, a new promising area of petroleum exploration is expecting a major "find" in the next two year period. The tax planning staff in the corporate headquarters in Shreveport, Louisiana, wish to estimate tax liablilices and effective tax burdens on this prospective income three ycars our.

The Zaire currency, the New Zaire (ZRN), is currently trading at ZRN100,000/USD. Although the goverument claims it is pegged to the dol lar, the stability of the currency is highly questionable. Given that inflation in Zaire has been rising (now averaging 20\% per ycar compared to the U.S.'s \(3 \%\) per year;, the tax planning staff would prefer to assume that the currency is likely to weaken over the period. In addition to the obvious problems with the New Zaire, the government of Zaire requires all petroleum companies operating there to turn over all hard-currency carnings to the government. Since oil is sold on world markets in U.S. dollars, the Zairean subsidiary's income actually begins in U.S. dollars and is then converted to local currency for tax purposes. (Wen the subsidiary declares a dividend to the parent company, it will have to apply to the government to obtain hard-currency, U.S. dollars, for payment to the U.S. parent.)

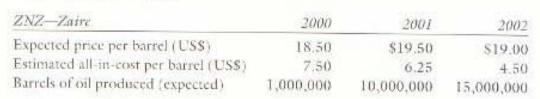

ZNZ has estimated the all-in-cost of production per barrel, as well as the estimated barrels produced, for the vears 2000-2002. The forecast oil price, which is a company-wide forecast from the corporate headquarters, is used for projecting revenues.

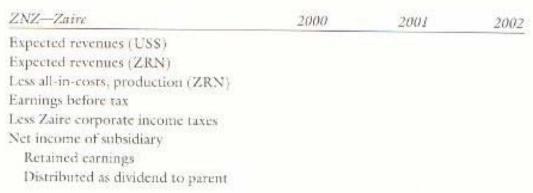

The current Zaire comporate income tax rate is \(50 \%\). In addition, the Zaire tax aurhoritics impose a \(20 \%\) withholding tax on dividends and interest remitted to forcign resident investors. Zaire has no current set of bilateral tax treatics, applying the same rates to all foreign investors regardless of country of origin. The parent company plans to reparriate \(50 \%\) of net income as dividends annually. Complete the following basic income statement in order to answer the following questions.

a. Calculate the expected exchange rate for the 2000 through 2002 period.

b. Calculate the net income available for distribution by the Zaire subsidiary for the years 2000 through 2002 , in both Zaire and U.S, dollars (assuming both a fixed and a depreciating Zaire dollar exchange rate).

c. What is the amount of the dividend that is expected to be remitted to the U.S. parent each year, after both income and withholding taxes, in U.S. dollars?

d. After gross-up for U.S. tax liability purposes, what is the total dividend after-tax (all Zaire and U.S. taxes) expected cach year?

c. What is the effective tax rate on this foreign-sourced income per year?

Step by Step Answer:

Multinational Business Finance

ISBN: 9780201635386

9th Edition

Authors: David K. Eiteman, Michael H. Moffett, Arthur I. Stonehill, Denise Clinton