Vocalise plc has recently assessed a new capital investment project that will expand its activities. This project

Question:

Vocalise plc has recently assessed a new capital investment project that will expand its activities. This project has an estimated expected net present value of £4m. This will require finance of £15m. At the same time, the business would like to buy and cancel £10m of 15 per cent debentures, which are due to be redeemed at par in four years’ time. It is estimated that the business will incur dealing costs of £0.3m in buying the debentures.

There are plans to raise most of the necessary finance for the investment project and for buying the debentures through a one-for-one rights issue of equity at an issue price of £0.50 per share. The remaining finance will come from the business’s existing cash resources. The issue will give rise to administrative costs of £0.4m.

None of these plans has been announced to the ‘market’, which is believed to be semi-strong efficient.

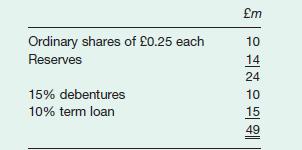

Vocalise plc’s capital structure is as follows:

The current and likely future rate of interest for loans to businesses like Vocalise plc is 10 per cent p.a. The business’s ordinary shares are currently quoted at £0.85 each.

(a) Estimate the theoretical share price following the announcement of the plans and the issue of the new shares, assuming that the only influences on the price are these plans. (Ignore taxation.)

(b) Why might the theoretical price differ from the actual one?

Step by Step Answer: