You work for an Israeli company that is considering an investment in Chinas Sichuan province. The investment

Question:

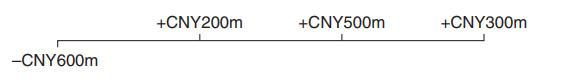

You work for an Israeli company that is considering an investment in China’s Sichuan province. The investment yields expected after-tax Chinese new yuan cash flows (in millions) as follows:

Expected inflation is 6 percent in shekels and 3 percent in yuan. Required returns for this risk-class are iILS = 15 percent in Israeli shekels and iCNY = 11.745 percent in yuan. The spot exchange rate is S0 ILS∕CNY = ILS 0.5526∕CNY. Assume the international parity conditions hold.

a. Calculate V0ILS|iCNY by discounting at the appropriate risk-adjusted yuan rate iCNY and then converting into shekels at the current spot rate.

b. Calculate V0ILS|iILS by converting yuan into shekels at expected future spot rates and then discounting at the appropriate rate in shekels.

Step by Step Answer: