Question: Repeat Example 6, except this time assume that you do not complete the worksheet, but all other statements are true. Data from Example 6 The

Repeat Example 6, except this time assume that you do not complete the worksheet, but all other statements are true.

Data from Example 6

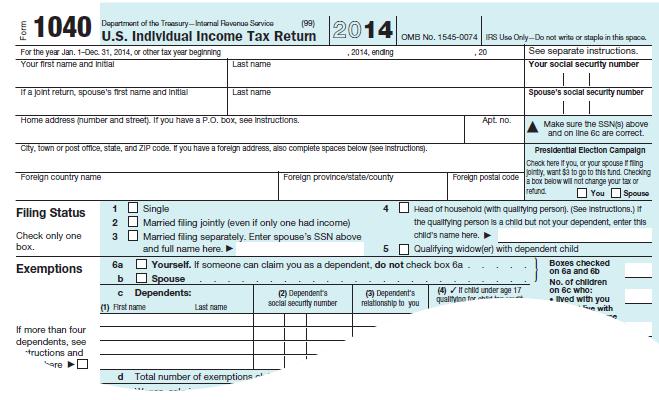

The following sentence is found on a tax form:

If you do not itemize deductions on Schedule A and you have charitable contributions, then complete the worksheet on page 14 and enter the allowable part on line 36b.

Use symbolic form to analyze this sentence.

1040 Department of the Treasury-Internal Ravenue Service For the year Jan. 1-Dec. 31, 2014, or other tax year beginning Your first name and Initial If a joint return, spouse's first name and initial (99) U.S. Individual Income Tax Return Foreign country name Home address (number and street). If you have a P.O. box, see Instructions. Filing Status Check only one box. Exemptions If more than four dependents, see -tructions and are City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see Instructions). 123 Last name Last name 6a b c Dependents: (1) First name Single Married filing jointly (even if only one had income) Married filing separately. Enter spouse's SSN above and full name here. Last name 2014 2014, ending Foreign province/state/county d Total number of exemptions OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. 20 See separate instructions. Your social security number 5 Yourself. If someone can claim you as a dependent, do not check box ba Spouse (2) Dependent's social security number Apt. no. Foreign postal code (3) Dependent's relationship to you Spouse's social security number Head of household (with qualifying person). (See Instructions.) if the qualifying person is a child but not your dependent, enter this child's name here. Make sure the SSN(s) above and on line 6c are correct. (4) If child under age 17 qualityine for Presidential Election Campaign Check here if you, or your spouse fing jointy, want $3 to go to this tund. Checking a box below will not change your tax or refund. You Spouse Qualifying widow(er) with dependent child Boxes checked on 6a and 6b No. of children on 6c who: Ilved with you with

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

From Example 6 we ... View full answer

Get step-by-step solutions from verified subject matter experts