Refer to Problem 17. Although Mr. Venkatesh of Elite Shipping has estimated the payoffs associated with the

Question:

1. For each alternative, plot the payoff value lines on a graph for P (low demand).

2. If the goal is to maximize expected payoffs, for what range of P (low demand) would the alternative building small would be the best choice?

3. If the goal is to maximize expected payoffs, is there any alternative that is not appropriate? Explain.

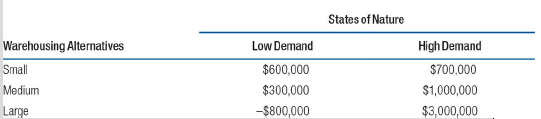

Table F.27

Data from problem 17

Elite Shipping Inc., a third-party logistics provider, in Chennai, India, is planning to build a new warehouse to accommodate the increasing demand for its warehousing services. Mr. Venkatesh, the CEO of the company, is not able to decide whether to build a small-, large-, or medium-size warehouse as future demand for the company€™s warehousing services is uncertain. If a small warehouse is built and demand is low, the company will have a net payoff of $600,000. Nevertheless, if demand turns to be high, the company has the option of expanding the existing warehouse or leasing additional warehousing facility. Expansion will provide a net payoff of $700,000, while the leasing option will have a net payoff of $400,000. If a medium-sized facility is built and demand turns out to be low, then the company will make $300,000. On the other hand, if demand turns out to be high, the net payoff will be $1 million.

Building a large warehouse to begin with will have a net payoff of $3 million if demand is high. If demand turns out to be low, then by building a large warehouse, the company will incur a loss of $800,000. The probability of high demand is 60%. What decision should Venkatesh make? Analyze the problem using a decision tree.

Step by Step Answer:

Operations Management Managing Global Supply Chains

ISBN: 978-1506302935

1st edition

Authors: Ray R. Venkataraman, Jeffrey K. Pinto