9 Linear programming models are used by many Wall Street firms to select a desirable bond portfolio.

Question:

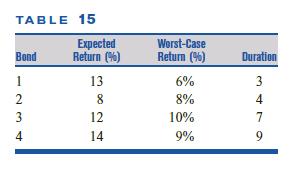

9 Linear programming models are used by many Wall Street firms to select a desirable bond portfolio. The following is a simplified version of such a model. Solodrex is considering investing in four bonds; $1,000,000 is available for investment. The expected annual return, the worst-case annual return on each bond, and the “duration”

of each bond are given in Table 15. The duration of a bond is a measure of the bond’s sensitivity to interest rates.

Solodrex wants to maximize the expected return from its bond investments, subject to three constraints.

Constraint 1 The worst-case return of the bond portfolio must be at least 8%.

Constraint 2 The average duration of the portfolio must be at most 6. For example, a portfolio that invested $600,000

in bond 1 and $400,000 in bond 4 would have an average duration of

![]()

Constraint 3 Because of diversification requirements, at most 40% of the total amount invested can be invested in a single bond.

Formulate an LP that will enable Solodrex to maximize the expected return on its investment.

Step by Step Answer:

Operations Research Applications And Algorithms

ISBN: 9780534380588

4th Edition

Authors: Wayne L. Winston