George Parker was paid a salary of $74,700 during 20-- by Umberger Company. In addition, during the

Question:

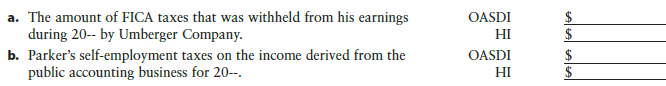

George Parker was paid a salary of $74,700 during 20-- by Umberger Company. In addition, during the year, Parker started his own business as a public accountant and reported a net business income of $60,000 on his income tax return for 20--. Compute the following:

Transcribed Image Text:

The amount of FICA taxes that was withheld from his earnings during 20-- by Umberger Company. b. Parker's self-employment taxes on the income derived from the public accounting business for 20--. OASDI HI OASDI HI

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (15 reviews)

a The amount of FICA taxes that was withheld from OASDI 463140 his earnings during 20 by Umberger ...View the full answer

Answered By

CHARLES AMBILA

I am an experienced tutor with more than 7 years of experience. I have helped thousands of students pursue their academic goals. My primary objective as a tutor is to ensure that students have easy time handling their academic tasks.

5.00+

109+ Reviews

324+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Gallagher Company has gathered the information needed to complete its Form 941 for the quarter ended September 30, 2018. Using the information presented below, complete Part 1 of Form 941, reproduced...

-

Herman Swayne is a waiter at the Dixie Hotel. In his first weekly pay in March, he earned $360.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($700.00),...

-

The following unemployment tax rate schedule is in effect for the calendar year 2018 in State A, which uses the reserve-ratio formula in determining employer contributions: Conrad Company, which is...

-

Factors that affect the selection of an inventory costing method do not include: (a) tax effects. (b) balance sheet effects. (c) income statement effects. (d) perpetual vs. periodic inventory system.

-

In the following program segment i, j, m, and n are integer variables. The values of m and n are supplied by the user earlier in the execution of the total program. for i : = 1 to m do for j : = 1 to...

-

Express each of the given expressions in simplest form with only positive exponents. 2t 2 + t 1 (t + 1)

-

Identify and account for transactions that affect different funds and/or account groups. AppendixLO1

-

Faldo Company produces a single product. The projected income statement for the coming year, based on sales of 200,000 units, is as follows: Sales ........... $2,000,000 Less: Variable costs .......

-

6. Luisa borrowed to buy a piano, paying $113 at the end of each month for 6 years. The bank charges interest on the loan at 7.14% compounded monthly. (a) What was the cash price of the piano? (b)...

-

a. Given the following graphs, calculate the total fixed costs, variable costs per unit, and sales price for Firm A. Firm Bs fixed costs are $120,000, its variable costs per unit are $4, and its...

-

Amanda Autry and Carley Wilson are partners in A & W Gift Shop, which employs the individuals listed below. Paychecks are distributed every Friday to all employees. Based on the information given,...

-

The monthly and hourly wage schedule for the employees of Quincy, Inc., follows. No employees are due overtime pay. Compute the following for the last monthly pay of the year: a. The total wages of...

-

In Section 10.2.2 we discussed how to find the shape of the surface of a rotating liquid. Consider the situation where the fluid is confined between two counter-rotating cylinders as shown in Figure...

-

Can anyone explain me how to calculate the ROI using the HISTORICAL COST NBV, the formula my instructor wants me to use is ADJ CF - HIST DEP /ASSETTOTAL - ACC DEP. And for the ROI of CURRENT COST NBV...

-

Consider the circuit to the right 3. If the total voltage supply in the circuit is 120V, and each resistor has a resistance of 400, what will the current read on each ammeter? |1= 12= 3 = 4. What...

-

1. The theory predicts the proportion of beans, in the four groups A, B, C and D should be 9:3:3:1. In an experiment among 1600 beans, the numbers in the four groups were 882, 313, 287 and 118. Does...

-

Would you recommend criminal charges in this case ( the screenshots below) and, if so, exactly which statutes against which person? Explain your reasoning (how the elements of the crime are met or...

-

check if each transaction is placed in the right place in each of the reports below and if there are any other mistakes in the different accounts after the first image which is a description of the...

-

For the following exercises, identify whether the statement represents an exponential function. Explain. The average annual population increase of a pack of wolves is 25.

-

Which of the following streaming TV devices does not involve use of a remote controller? A) Google Chromecast B) Apple TV C) Amazon Fire TV D) Roku

-

Summarize the procedure that may be followed by the Human Resources Department in hiring new employees.

-

What information is commonly provided by a jobseeker on the application for employment form?

-

What is the significance of the Civil Rights Act of 1964 and the Age Discrimination in Employment Act in the employer's use of prehire inquiries?

-

Compute the value of ordinary bonds under the following circumstances assuming that the coupon rate is 0.06:(either the correct formula(s) or the correct key strokes must be shown here to receive...

-

A tax-exempt municipal bond has a yield to maturity of 3.92%. An investor, who has a marginal tax rate of 40.00%, would prefer and an otherwise identical taxable corporate bond if it had a yield to...

-

Please note, kindly no handwriting. Q. Suppose a 3 year bond with a 6% coupon rate that was purchased for $760 and had a promised yield of 8%. Suppose that interest rates increased and the price of...

Study smarter with the SolutionInn App